District 110 is at a financial crossroads

THE NEED

Why is ISD 110 Pursuing a Levy Referendum?

After making $4.6 million in budget adjustments, mostly cuts, in the Spring of 2023, and achieving a positive fund balance for the first time since 2017, Waconia Public Schools is at a financial crossroads as it focuses on the future and what matters most.

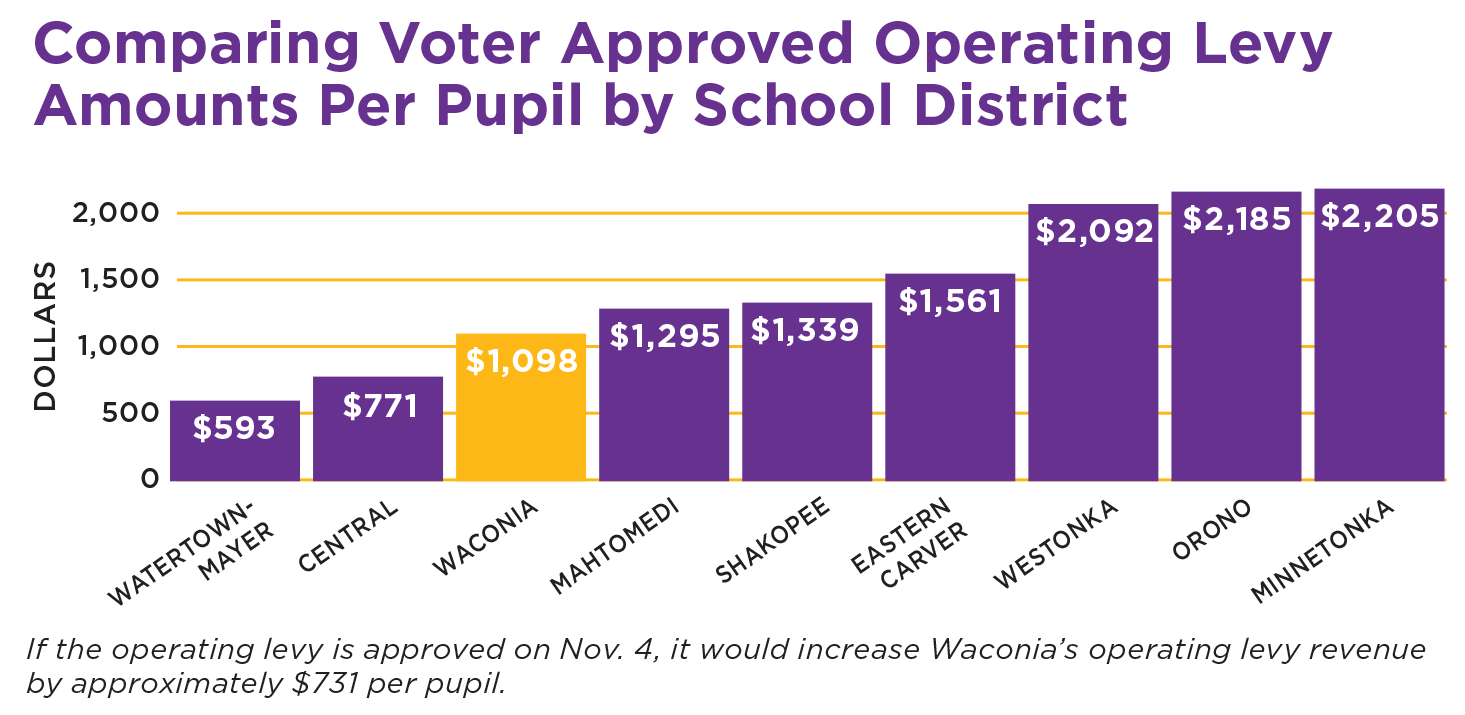

The district remains in the bottom 25% of all districts in the State of Minnesota when it comes to per pupil revenue.

The decision to pursue a $3 million operating levy on November 4 is an attempt to maintain what district residents say they value most about Waconia Public Schools:

High-quality and experienced teachers and staff

A broad range of academic and co-curricular programs

Class sizes that foster the best environment for student achievement

$4.6 Million in Budget Adjustments

Administration

Elem. Specials

Class Sizes

Media Specialists

Supplies & Tech

Athletic Coaches

Increased Fees

District 110 Financial Snapshot

Flat enrollment since 2020

BOTTOM 2%

Of MN school districts in per pupil State aid

BOTTOM 25%

Of MN school districts in per pupil funding when you factor in operating levies

PROVEN FISCAL RESPONSIBILITY

District is OUT of SOD and foresees a projected fund balance of $3M in FY 2025

$4.6 Million

Budget Reductions & Adjustments in 2023

$1.6 Million

Projected deficit spend in 2026-27 Another $3.1 projected deficit spend in 2027-28

BEHIND MANY COMPARABLE DISTRICTS

In Per-Pupil Student Funding

2027

Due to projected funding deficits, District will require either additional revenue or make additional budget reductions

The Process to Arrive at the Operating Levy Referendum

School board members and district administration have been working tirelessly to address budget shortfalls caused by a variety of factors. They have engaged the community at regular intervals to understand what is most important to residents of District 110.

State Mandates, Declining Enrollment & Other Budget Impacts

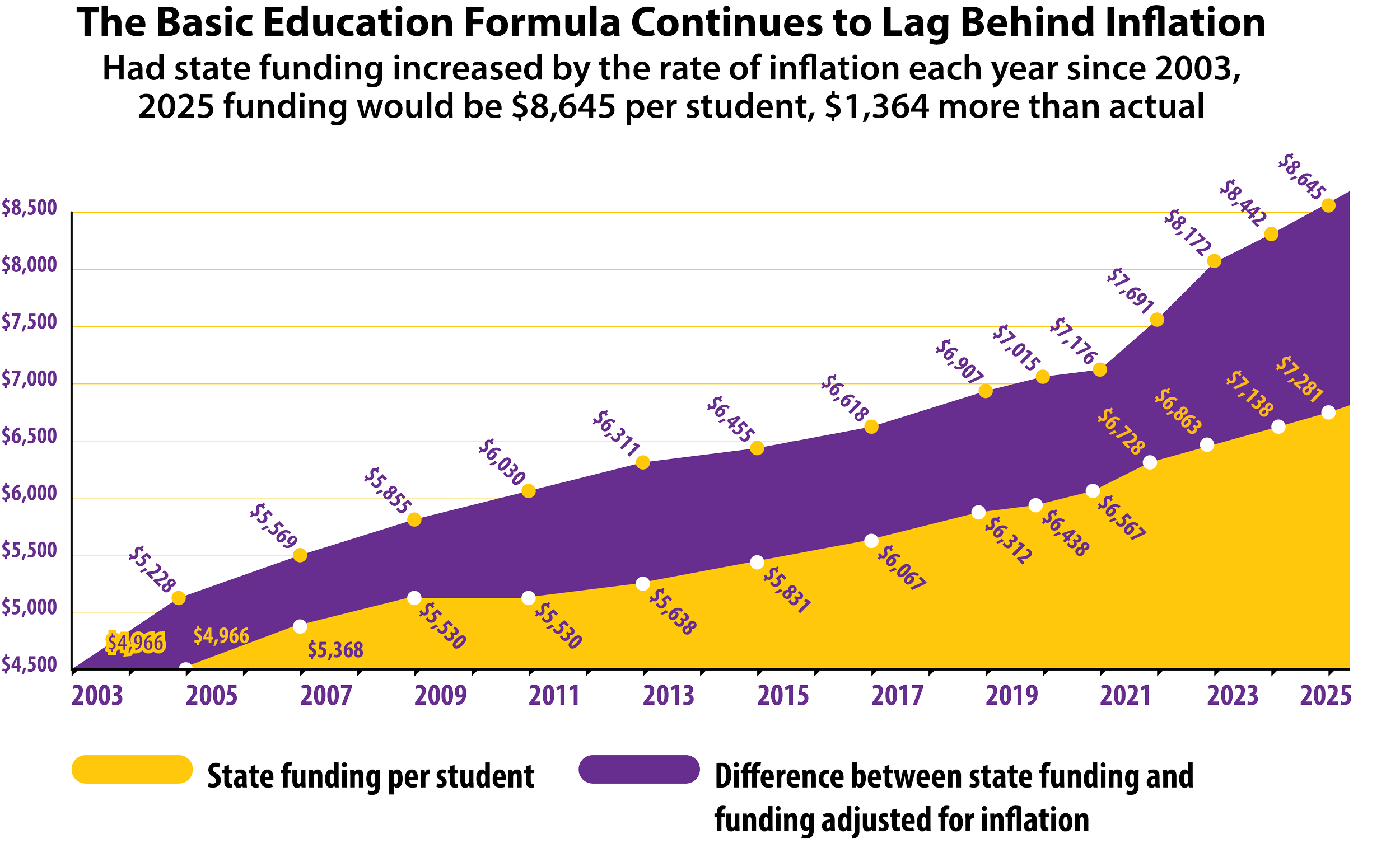

In 2023, the State of Minnesota approved a significant increase in revenue for schools, for which we are thankful. Unfortunately, the state also increased the number of unfunded or underfunded mandates.

Our enrollment numbers have leveled off since 2020 and have even experienced a slight decrease in recent years. This is due to several factors, including lower birth rate, a move during the pandemic by families to homeschool children, and competition from private schools.

Other budget impacts include:

Increased costs of employee salaries and benefits

Increased costs related to purchased services including transportation

Increased costs related to inflation